What is the True Cost of the Interest Rate Increase?

Dear Friends,

It’s probably no surprise that rising interest rates have a significant impact on your pocket book.

But how much of an impact? The True Cost may shock you!

Consider this:

The average stay in a home is 5 to 7 years

according to the National Association of Realtors®.

Knowing you like to stay informed, we have provided three real-world home buying scenarios in the graphics below. From these hypothetical comparisons, we hope you can get a better idea of the true cost of the interest rate hikes that are expected in the near future.

Assuming that you remain in your new home for 7 years, it is very clear the HUGE impact of rising interest rates.

WAITING TO BUY could cost you THOUSANDS of dollars!

(Visit our website to view larger PDF graphics of these three scenarios.)

Home “A” Costs $150,000

At the current interest rate of 4.875%, the monthly payment will be $797.

If you wait until the interest rate rises to 6%,

your monthly payment will increase by $85,

for a total annual increase of $1020!

If you stay in that home for 7 years,

you will be spending $7140 MORE!

What could you do with an extra $7140?

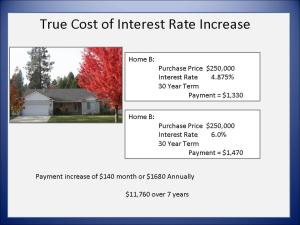

Waiting to purchase this $250,000 home could cost you

$140 per month

$1680 per year

If you stay in that home for 7 years,

you will be spending $11,760 MORE!

What could you do with an extra $11,760?

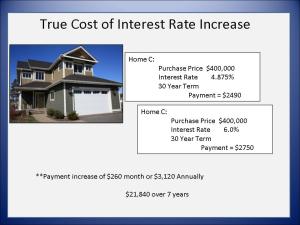

What could you do with an extra

$21,840?

Thinking of buying? Now is a great time, if you want to save $$ in your monthly budget, as well as over the life of your potential mortgage.

Are you waiting for a lower purchase price?

The “savings” of a few thousand dollars off the purchase price will actually COST you THOUSANDS when the interest rates rise.

Don’t wait to make your next Real Estate move.

Call Now

to take advantage of

High Inventory and Low Interest Rates!

As experienced REALTORS®, and long-time North Idaho residents, we can provide an impressive list of professionals whom we’ve come to trust over the years. With our expertise in guiding our clients through all kinds of Real Estate transactions, we are uniquely qualified to help you achieve your real estate goals in 2011!

We’ll help you navigate through every phase of the process.

Randy Oetken 208-660-0518

Christy Oetken 208-660-0506

Oetken@RealEstate-Browser.com

How to Compete Against Bank-Owned and Short Sales Homes

Here’s a blog article that we thought you might appreciate, written by a noted Short Sale Real Estate expert.

Here’s a blog article that we thought you might appreciate, written by a noted Short Sale Real Estate expert.

Wondering what your Coeur d’Alene area property is REALLY worth in today’s market? Call us for a FREE Market Analysis.

We’d love to help you get the information you need, and to help you decide if selling your property is right for you.

Put us to work for you!

By Elizabeth Weintraub, About.com Guide

If the house for sale next door to you is a bank-owned home, but all the other homes for sale in the neighborhood are not, you don’t have much of a problem. However, if most of the homes that have recently sold in your area were bank-owned homes and short sales, you have a problem. That problem is you must compete with foreclosures and short sales to sell your home.

Your home’s market value is directly related to distressed sales if those short sales and foreclosures dominate the neighborhood.

Prior to the real estate bubble of the mid-2000’s, appraisers would often ignore the distressed sales when appraising a home. Since then, appraisers pay close attention to the number of distressed sales that have closed and those presently for sale. What’s a regular seller with equity supposed to do to compete?

Pricing a Home With Equity Against Foreclosures and Short Sales

Pricing a home is at best a mix of facts, science and emotions. It’s a combination of wearing a seller’s hat and stepping into the buyer’s shoes. Bear in mind that it doesn’t matter much how much you think your home is worth if a buyer disagrees. Try answering these 3 questions:

- What would make a buyer buy your home over a foreclosure or a short sale?

- Why would a buyer’s lender appraise your home for more than a foreclosure or short sale?

- How much more is your home worth than a distressed sale?

You might be surprised at the answers. The truth is your home is not worth a whole lot more than a foreclosure, even if you put in upgrades, if all the recent sales are foreclosures and short sales. Appraisers don’t give a huge allowance for upgrades like they used to do.

Buyers want a good deal. They might buy a home that needs carpeting, for example, if adding the cost of new carpeting still makes that bank-owned home’s price attractive. On the other hand, if your home, with equity, is in tip-top shape and priced within the range of distressed sales, a buyer is much more likely to choose your home.

However, say, a bank-owned home priced at $200,000 needs $10,000 worth of work or improvements. If your home doesn’t need any work, a buyer might offer only $210,000 for your home.

Examine the Foreclosed and Short Sale Comparable Sales

- Look at every similar home that has sold in the neighborhood over the past three months to determine comparable sales. The list should contain homes within a 1/4 mile to a 1/2 mile and no further, unless there are only a handful of comps in the general vicinity or the property is rural.

- Pay attention to neighborhood dividing lines and physical barriers such as major streets, freeways or railroads, and do not compare inventory from the “other side of the tracks.” Where I live in the Land Park neighborhood of Sacramento, for example, identical homes across the street from each other can vary by $100,000. Perceptions and desirability have value.

- Compare similar square footage, within 10% up or down from the subject property, if possible.

- Compare homes with similar ages. One neighborhood might consist of homes built in the 1950s, co-mingled with another ring of construction from the 1980s. Values between the two will differ. Compare apples to apples.

Tip: I suggest to my Sacramento clients that they price homes among distressed sales a little bit below market value. This tends to drive multiple offers as buyers outbid each other, resulting in a higher sales price for sellers.

http://homebuying.about.com/od/sellingahouse/qt/compete-foreclosure-short-sale.htm

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link