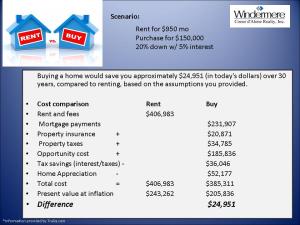

Should I Buy or just Rent? A Cost/Benefit Analysis

You might be surprised to find that a careful Cost/Benefit Analysis still favors BUYING, despite increasing interest rates. Here’s one scenario:

1. The cost of an alternative that must be forgone in order to pursue a certain action. Put another way, the benefits you could have received by taking an alternative action.2. The difference in return between a chosen investment and one that is necessarily passed up. Say you invest in a stock and it returns a paltry 2% over the year. In placing your money in the stock, you gave up the opportunity of another investment – say, a risk-free government bond yielding 6%. In this situation, your opportunity costs are 4% (6% – 2%).Investopedia explains Opportunity Cost

1. The opportunity cost of going to college is the moneyyou would have earned if you worked instead. On the one hand, you lose four years of salary while getting your degree; on the other hand, you hope to earn more during your career, thanks to your education, to offset the lost wages.Here’s another example: if a gardener decides to grow carrots, his or her opportunity cost is the alternative crop that might have been grown instead (potatoes, tomatoes, pumpkins, etc.).In both cases, a choice between two options must be made. It would be an easy decision if you knew the end outcome; however, the risk that you could achieve greater “benefits” (be they monetary or otherwise) with another option is the opportunity cost.

We’d love to help you decide if buying is right for you. Let us help you calculate your own Cost/Benefit Analysis.

208-660-0506

Oetkens Named 2011 Windermere Coeur d’Alene Realty Top Listers

Here’s a “sneak peek” at our Front Page Ad that will be published in tomorrow’s Coeur d’Alene Press.

Thinking of selling? We’re hard workers. Put us to work for you!

Call us for your FREE Comparative Market Analysis.

To see what your home, land, investment or commercial property is worth in today’s market, call

Randy Oetken

208-660-0518

or

Christy Oetken

208-660-0506

of

Windermere Coeur d’Alene Realty

Oetken@RealEstate-Browser.com

We will work hard for YOU!

Visit our websites:

Real estate: It’s time to buy again

Forget stocks. Don’t bet on gold. After four years of plunging home prices, the most attractive asset class in America is housing.

Forget stocks. Don’t bet on gold. After four years of plunging home prices, the most attractive asset class in America is housing.

Castleman is in a unique position to know. As the founder and CEO of a company called Metrostudy, he’s spent more than three decades tracking real-time data on the country’s inventory of new homes….

…Today Castleman is witnessing an extraordinary reversal of the new-home glut that helped sink prices just a few years ago. In the 41 cities Metrostudy covers, a total of 78,000 houses are now either vacant and for sale, or under construction. That’s less than one-fourth of the 343,000 units in those two categories at the peak of the frenzy in mid-2006, and well below the level of a decade ago. “If we had anything like normal levels of buying, those houses would sell in 2½ months,” says Castleman. “We’d see an incredible shortage. And that’s where we’re heading.”

To see where real estate is truly headed, it’s critical to keep your eye firmly on the fundamentals that, over time, always determine the course of prices and construction. During the last decade’s historic run-up in prices, Fortune repeatedly warned that things were moving too fast. In a cover story titled “Is the Housing Boom Over?,” this writer’s analysis found that the basic forces that govern the market — the cost of owning vs. renting and the level of new construction — were in bubble territory. Eventually reality set in, and prices plummeted. Our current view focuses on those same fundamentals — only now they’re pointing in the opposite direction.

So let’s state it simply and forcibly: Housing is back.

Excerpted from

Real estate: It’s time to buy again

Read the full article:

http://finance.fortune.cnn.com/2011/03/28/real-estate-its-time-to-buy-again/

For more information on New Construction in North Idaho, visit Our Listings page.

2011 Windermere Market Review

Our Annual Windermere Report (see link below) is an overview of last year’s real estate market and a forecast of the trends, opportunities, and challenges we can expect in the coming months.

Forecasting the future is always a risky business. However, we continue to remain optimistic about the future of our local real estate market. Why? Because families and retiring baby boomers will continue to seek out healthy communities that offer recreational opportunities, excellent schools and quality health care. And here in Kootenai County, we have these in abundance!

Are you interested in learning how all of this relates to the value of your property in today’s market? Whether you are evaluating investment strategies, tax or estate planning, or perhaps considering a change of address, we are here to help you! We would be happy to prepare a market value report for you, compiled on activity in your local neighborhood and specific to your property.

If you would like a custom market value report, or if you know of someone who needs professional advice regarding real estate, please don’t hesitate to call us.

In the meantime, we hope you find the “Windermere Report” informative. We look forward to talking to you soon.

Sincerely,

2011 Windermere Market Review

Most Bang for Your Buck: Replace the Front Door in 2011!

Daily Real Estate News | December 16, 2010 |

Owners Recoup More with Exterior Home Projects

As part of the 2010-11 Remodeling Cost vs. Value Report, Realtors® recently rated exterior replacement projects among the most cost-effective home improvement projects, demonstrating that curb appeal remains one of the most important aspects of a home at resale time.

“This year’s Remodeling Cost vs. Value Report highlights the importance of exterior projects, which not only provide the most value, but also are among the least expensive improvements for a home,” said National Association of Realtors® President Ron Phipps, broker-president of Phipps Realty in Warwick, R.I. “Since resale value can vary by region, it’s smart for home owners to work with a Realtor®through the remodeling and improvement process; they can provide insight into projects in their neighborhoods that will recoup the most when the owners are ready to sell.”

Nine of the top 10 most cost-effective projects nationally in terms of value recouped are exterior replacement projects. The steel entry door replacement remained the project that returned the most money, with an estimated 102.1 percent of cost recouped upon resale; it is also the only project in this year’s report that is expected to return more than the cost. The midrange garage door replacement, a new addition to the report this year, is expected to recoup 83.9 percent of costs. Both projects are small investments that cost little more than $1,200 each, on average. Realtors® identified these two replacements as projects that can significantly improve a home’s curb appeal.

“Curb appeal remains king – it’s the first thing potential buyers notice when looking for a home, and it also demonstrates pride of ownership,” said Phipps.

The 2010-11 Remodeling Cost vs. Value Report compares construction costs with resale values for 35 midrange and upscale remodeling projects comprising additions, remodels and replacements in 80 markets across the country. Data are grouped in nine U.S. regions, following the divisions established by the U.S. Census Bureau. This is the 13th consecutive year that the report, which is produced by Remodeling magazine publisher Hanley Wood, LLC, was completed in cooperation with REALTOR® Magazine.

Realtors® provided their insight into local markets and buyer home preferences within those markets. Overall, Realtors® estimated that home owners would recoup an average of 60 percent of their investment in 35 different improvement projects, down from an average of 63.8 percent last year. Remodeling projects, particularly higher cost upscale projects, have been losing resale value in recent years because of weak economic conditions.

According to the report, replacement projects usually outperform remodel and addition projects in resale value because they are among the least expensive and contribute to curb appeal. Various types of siding and window replacement projects were expected to return more than 70 percent of costs. Upscale fiber-cement siding replacement was judged by Realtors® the most cost effective among siding projects, recouping 80 percent of costs. Among the window replacement projects covered, upscale vinyl window replacements were expected to recoup the most, 72.6 percent upon resale. Another exterior project, a wood deck addition, tied with a minor kitchen remodel for the fourth most profitable project recouping an estimated 72.8 percent of costs.

The top interior projects for resale value included an attic bedroom and a basement remodel. Both add living space without extending the footprint of the house. An attic bedroom addition costs more than $51,000 and recoups an estimated 72.2 percent nationally upon resale; a basement remodel costs more than $64,000 and recoups an estimated 70 percent. Improvement projects that are expected to return the least are a midrange home office remodel, recouping an estimated 45.8 percent; a backup power generator, recouping 48.5 percent; and a sunroom addition, recouping 48.6 percent of costs.

Although most regions followed the national trends, the regions that consistently were estimated to return a higher percentage of remodeling costs upon resale were the Pacific region of Alaska, California, Hawaii, Oregon and Washington; the West South Central region of Arkansas, Louisiana, Oklahoma, and Texas; the East South Central region of Alabama, Kentucky, Mississippi and Tennessee; and the South Atlantic region of the District of Columbia, Florida, Georgia, Maryland, North Carolina, South Carolina, Virginia and West Virginia.

The regions where Realtors® generally reported the lowest percentage of costs recouped were New England (Connecticut, Massachusetts, Maine, New Hampshire, Rhode Island, and Vermont), East North Central (Illinois, Indiana, Michigan, Ohio and Wisconsin), West North Central (Iowa, Kansas, Minnesota, Missouri, Nebraska, North Dakota and South Dakota), and Middle Atlantic (New York and Pennsylvania).

“It’s important to remember that the resale value of a particular improvement project depends on several factors,” said Phipps. “Things such as the home’s overall condition, availability and condition of surrounding properties, location and the regional economic climate contribute to an estimated resale value. That’s why it is imperative to work with a Realtor®who can provide insight and guidance into local market conditions whether you’re buying, selling or improving a home.”

Results of the report are summarized in the January issue of REALTOR® Magazine. To read the full project descriptions, access national and regional project data, and download a free PDF containing data for any of the 80 cities covered by the report, visit www.costvsvalue.com.

Source: NAR

http://www.realtor.org/press_room/news_releases/2010/12/home_owners_recoup

Market News: SOLD Residential Comparison 2005 – 2010

Here’s the data from the Coeur d’Alene MLS.

Are you thinking of selling your home in 2011?

The Pending Home Sales Index,* a forward-looking indicator, rose 10.4 percent to 89.3 based on contracts signed in October from 80.9 in September. The index remains 20.5 percent below a surge to a cyclical peak of 112.4 in October 2009, which was the highest level since May 2006 when it hit 112.6 http://realestatebrowser.wordpress.com/2010/12/07/strong-rebound-in-pending-home-sales/

Find out the true Market Value of your Coeur d’Alene area property. Call us for your FREE Market Analysis.

We’d like to help you decide if the time is right for you to sell your property.

By the way…We Have Buyers!

How to Compete Against Bank-Owned and Short Sales Homes

Here’s a blog article that we thought you might appreciate, written by a noted Short Sale Real Estate expert.

Here’s a blog article that we thought you might appreciate, written by a noted Short Sale Real Estate expert.

Wondering what your Coeur d’Alene area property is REALLY worth in today’s market? Call us for a FREE Market Analysis.

We’d love to help you get the information you need, and to help you decide if selling your property is right for you.

Put us to work for you!

By Elizabeth Weintraub, About.com Guide

If the house for sale next door to you is a bank-owned home, but all the other homes for sale in the neighborhood are not, you don’t have much of a problem. However, if most of the homes that have recently sold in your area were bank-owned homes and short sales, you have a problem. That problem is you must compete with foreclosures and short sales to sell your home.

Your home’s market value is directly related to distressed sales if those short sales and foreclosures dominate the neighborhood.

Prior to the real estate bubble of the mid-2000’s, appraisers would often ignore the distressed sales when appraising a home. Since then, appraisers pay close attention to the number of distressed sales that have closed and those presently for sale. What’s a regular seller with equity supposed to do to compete?

Pricing a Home With Equity Against Foreclosures and Short Sales

Pricing a home is at best a mix of facts, science and emotions. It’s a combination of wearing a seller’s hat and stepping into the buyer’s shoes. Bear in mind that it doesn’t matter much how much you think your home is worth if a buyer disagrees. Try answering these 3 questions:

- What would make a buyer buy your home over a foreclosure or a short sale?

- Why would a buyer’s lender appraise your home for more than a foreclosure or short sale?

- How much more is your home worth than a distressed sale?

You might be surprised at the answers. The truth is your home is not worth a whole lot more than a foreclosure, even if you put in upgrades, if all the recent sales are foreclosures and short sales. Appraisers don’t give a huge allowance for upgrades like they used to do.

Buyers want a good deal. They might buy a home that needs carpeting, for example, if adding the cost of new carpeting still makes that bank-owned home’s price attractive. On the other hand, if your home, with equity, is in tip-top shape and priced within the range of distressed sales, a buyer is much more likely to choose your home.

However, say, a bank-owned home priced at $200,000 needs $10,000 worth of work or improvements. If your home doesn’t need any work, a buyer might offer only $210,000 for your home.

Examine the Foreclosed and Short Sale Comparable Sales

- Look at every similar home that has sold in the neighborhood over the past three months to determine comparable sales. The list should contain homes within a 1/4 mile to a 1/2 mile and no further, unless there are only a handful of comps in the general vicinity or the property is rural.

- Pay attention to neighborhood dividing lines and physical barriers such as major streets, freeways or railroads, and do not compare inventory from the “other side of the tracks.” Where I live in the Land Park neighborhood of Sacramento, for example, identical homes across the street from each other can vary by $100,000. Perceptions and desirability have value.

- Compare similar square footage, within 10% up or down from the subject property, if possible.

- Compare homes with similar ages. One neighborhood might consist of homes built in the 1950s, co-mingled with another ring of construction from the 1980s. Values between the two will differ. Compare apples to apples.

Tip: I suggest to my Sacramento clients that they price homes among distressed sales a little bit below market value. This tends to drive multiple offers as buyers outbid each other, resulting in a higher sales price for sellers.

http://homebuying.about.com/od/sellingahouse/qt/compete-foreclosure-short-sale.htm

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link