What do you think: Require 20% Down?

Friends,

We pass this along to you in an effort to keep you informed. This article was forwarded to us this week from various sources, especially the Realtor Action Center.

We’d love to hear from you. Comments are open for your opinion on the proposed 20% Down Payment requirement.

Proposed QRM Regulations Could Stifle Housing Market

The National Association of REALTORS is encouraging its members to contact Congress about the proposed regulations governing Qualified Residential Mortgages (QRM). If approved, all homebuyers would be required to pay a 20% down payment when buying a home. This would have a detrimental impact on the real estate industry and the overall economy. Economic recovery depends largely on a housing market recovery; therefore implementing a new rule requiring a 20% or higher down-payment would stop the housing recovery in its tracks.

NAR asks that you consider contacting Congress today and ask them to please make it clear to the regulators that this was not their legislative intent and to instead implement a more reasonable Qualified Residential Mortgage (QRM) that will keep credit-worthy buyers in the market and able to acquire a loan.

It’s very easy to do; just go to the REALTOR Action Center and the website does everything else for you.

Nationwide Open House Dream Weekend, June 4 and 5

Watch for more information on our Dream Weekend Open Houses.

We will be showcasing some of Our Listings on June 4 & 5!

Summer Event Will Put Spotlight on Home Ownership

The 2011 REALTOR® Nationwide Open House will be held on the weekend of, June 4-5, 2011. This event, which began on a local level a few years ago, is a weekend when REALTORS® across the country—and across the globe—are invited to hold open houses in their area. It is designed to drive buyers’ attention and interest to homes for sale and offers opportunities to educate the public about the benefits of home ownership.

What is the True Cost of the Interest Rate Increase?

Dear Friends,

It’s probably no surprise that rising interest rates have a significant impact on your pocket book.

But how much of an impact? The True Cost may shock you!

Consider this:

The average stay in a home is 5 to 7 years

according to the National Association of Realtors®.

Knowing you like to stay informed, we have provided three real-world home buying scenarios in the graphics below. From these hypothetical comparisons, we hope you can get a better idea of the true cost of the interest rate hikes that are expected in the near future.

Assuming that you remain in your new home for 7 years, it is very clear the HUGE impact of rising interest rates.

WAITING TO BUY could cost you THOUSANDS of dollars!

(Visit our website to view larger PDF graphics of these three scenarios.)

Home “A” Costs $150,000

At the current interest rate of 4.875%, the monthly payment will be $797.

If you wait until the interest rate rises to 6%,

your monthly payment will increase by $85,

for a total annual increase of $1020!

If you stay in that home for 7 years,

you will be spending $7140 MORE!

What could you do with an extra $7140?

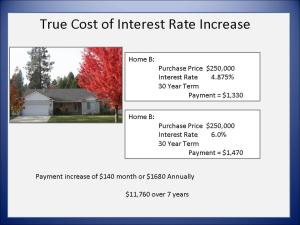

Waiting to purchase this $250,000 home could cost you

$140 per month

$1680 per year

If you stay in that home for 7 years,

you will be spending $11,760 MORE!

What could you do with an extra $11,760?

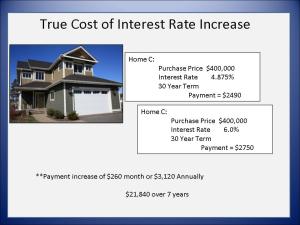

What could you do with an extra

$21,840?

Thinking of buying? Now is a great time, if you want to save $$ in your monthly budget, as well as over the life of your potential mortgage.

Are you waiting for a lower purchase price?

The “savings” of a few thousand dollars off the purchase price will actually COST you THOUSANDS when the interest rates rise.

Don’t wait to make your next Real Estate move.

Call Now

to take advantage of

High Inventory and Low Interest Rates!

As experienced REALTORS®, and long-time North Idaho residents, we can provide an impressive list of professionals whom we’ve come to trust over the years. With our expertise in guiding our clients through all kinds of Real Estate transactions, we are uniquely qualified to help you achieve your real estate goals in 2011!

We’ll help you navigate through every phase of the process.

Randy Oetken 208-660-0518

Christy Oetken 208-660-0506

Oetken@RealEstate-Browser.com

Oetkens Named 2011 Windermere Coeur d’Alene Realty Top Listers

Here’s a “sneak peek” at our Front Page Ad that will be published in tomorrow’s Coeur d’Alene Press.

Thinking of selling? We’re hard workers. Put us to work for you!

Call us for your FREE Comparative Market Analysis.

To see what your home, land, investment or commercial property is worth in today’s market, call

Randy Oetken

208-660-0518

or

Christy Oetken

208-660-0506

of

Windermere Coeur d’Alene Realty

Oetken@RealEstate-Browser.com

We will work hard for YOU!

Visit our websites:

Real estate: It’s time to buy again

Forget stocks. Don’t bet on gold. After four years of plunging home prices, the most attractive asset class in America is housing.

Forget stocks. Don’t bet on gold. After four years of plunging home prices, the most attractive asset class in America is housing.

Castleman is in a unique position to know. As the founder and CEO of a company called Metrostudy, he’s spent more than three decades tracking real-time data on the country’s inventory of new homes….

…Today Castleman is witnessing an extraordinary reversal of the new-home glut that helped sink prices just a few years ago. In the 41 cities Metrostudy covers, a total of 78,000 houses are now either vacant and for sale, or under construction. That’s less than one-fourth of the 343,000 units in those two categories at the peak of the frenzy in mid-2006, and well below the level of a decade ago. “If we had anything like normal levels of buying, those houses would sell in 2½ months,” says Castleman. “We’d see an incredible shortage. And that’s where we’re heading.”

To see where real estate is truly headed, it’s critical to keep your eye firmly on the fundamentals that, over time, always determine the course of prices and construction. During the last decade’s historic run-up in prices, Fortune repeatedly warned that things were moving too fast. In a cover story titled “Is the Housing Boom Over?,” this writer’s analysis found that the basic forces that govern the market — the cost of owning vs. renting and the level of new construction — were in bubble territory. Eventually reality set in, and prices plummeted. Our current view focuses on those same fundamentals — only now they’re pointing in the opposite direction.

So let’s state it simply and forcibly: Housing is back.

Excerpted from

Real estate: It’s time to buy again

Read the full article:

http://finance.fortune.cnn.com/2011/03/28/real-estate-its-time-to-buy-again/

For more information on New Construction in North Idaho, visit Our Listings page.

Good News: Existing Home Sales Jump

As you wander through life,

As you wander through life,

whatever be your goal,

keep your eye on the donut

and not on the hole!

-Sign in the Mayflower Coffee Shop, Chicago

This quote came to us through our Windermere Coeur d’Alene Realty newsletter this week, and we thought you would appreciate it.

It’s also a great introduction to the Market News that we want to pass along to you today. It’s GOOD NEWS, especially in the context of the news of recent years.

Daily Real Estate News | January 20, 2011

REALTOR® Magazine-Daily News-December Existing-Home Sales JumpExisting-home sales rose sharply in December, when sales increased for the fifth time in the past six months, according to the National Association of REALTORS®.

Existing-home sales, which are completed transactions that include single-family, townhomes, condominiums and co-ops, rose 12.3 percent to a seasonally adjusted annual rate of 5.28 million in December from an upwardly revised 4.70 million in November, but remain 2.9 percent below the 5.44 million pace in December 2009.

Lawrence Yun, NAR chief economist, said sales are on an uptrend. “December was a good finish to 2010, when sales fluctuate more than normal. The pattern over the past six months is clearly showing a recovery,” he said. “The December pace is near the volume we’re expecting for 2011, so the market is getting much closer to an adequate, sustainable level. The recovery will likely continue as job growth gains momentum and rising rents encourage more renters into ownership while exceptional affordability conditions remain.”

The national median existing-home price for all housing types was $168,800 in December, which is 1.0 percent below December 2009. Distressed homes rose to a 36 percent market share in December from 33 percent in November, and 32 percent in December 2009.

“The modest rise in distressed sales, which typically are discounted 10 to 15 percent relative to traditional homes, dampened the median price in December, but the flat price trend continues,” Yun explained.

We’ve been focusing on the donut instead of the hole – and we’ve already closed several transactions in 2011!

We have strategies that WORK! We can help you buy or sell real estate this year. Call us Today!

Randy or Christy Oetken

208-660-0506

Mortgage Interest Deduction: WE SUPPORT IT!

Mortgage Interest Deduction? OF COURSE!

We’re with Lawrence Yun, of the National Association of Realtors:

It’s a common misperception that the mortgage interest deduction benefits primarily the wealthy, as argued in the Washington Post’s January 1 editorial, “Trim the Excessive Tax Subsidy for Real Estate.”

In fact, the MID actually benefits primarily middle- and lower income families. Sixty five percent of families who claim the MID earn less than $100,000 per year, and 91 percent who claim the benefit earn less than $200,000 per year. As a percentage of income, the biggest MID beneficiaries are younger middle-class families.

The MID helps many families become home owners by reducing the carrying costs of owning a home. The ability to deduct the interest paid on a mortgage can mean significant savings at tax time. For example, a family who bought a home last year with a $200,000, 30-year, fixed-rate mortgage, assuming an interest rate of 5 percent, could save nearly $3,500 in federal taxes when they file next year. That’s real money they can use to pay down other debts, save for their children’s college education, or put away for retirement.

It’s no wonder, then, that most Americans support the MID. In fact, in a recent NAR survey by Harris Interactive of 3,000 home owners and renters, nearly three-fourths of home owners and two-thirds of renters said the MID was extremely or very important to them.

Unlike the very rich, much of whose wealth is tied to the stock market, the wealth of most middle-class American families is connected to their home. Millions of these Americans bought their homes with the understanding that mortgage interest is tax-deductible, and many of them have steadily paid down their mortgages to build equity in their home. Eliminating or reducing the MID would destroy part of this hard-earned equity for all home owners, independent of their tax filing status.

Furthermore, we also need to be mindful that home owners already pay 80 percent to 90 percent of U.S. federal income tax, and this share could rise to 95 percent if the MID is eliminated. Proposals that would remove certain tax benefits in return for lower tax rates just may hold for one or two terms of Congress before the tax rates are changed again. Americans are not naïve; they understand the nature of Washington politics.

For people who don’t have hundreds of thousands of dollars in savings to buy a home outright, tax benefits like the MID help them begin building their futures through home ownership…

We’d like to know what YOU think! Take our poll!

“Do You Support the Mortgage Interest Deduction?”

Comments are open, and we hope you’ll express your opinion! We’d love to hear from you.

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link