North Idaho Real Estate Market: You May Be Interested to Know…

We thought you’d like to know a few facts about our ever-changing (improving!) Real Estate Market in North Idaho:

We thought you’d like to know a few facts about our ever-changing (improving!) Real Estate Market in North Idaho:

•Pending Homes sales are the highest they have been since they were impacted by the Home Buyers’ Credit back in April of 2010.

•We are WAY AHEAD of the National Average in Annual Appreciation if you take out the “Boom Years”(late 04-07), and replace them with a steady consistent annual growth rate of 2.4%.

•We are seeing Consistent Activity in the Higher End Market

•Under $150,000 continues to be a Sellers market.

Now you’re asking yourself:

What in the world can I do with this information?

We’d love to help you leverage this info to your advantage. Call us today! We can help you:

- take advantage of historically low interest rates

- gain the advantage in bidding wars

- grow your Real Estate Investment Portfolio

- get the best price for your home, land or commercial property

Call

Randy & Christy Oetken

208-660-0506

Oetken@RealEstate-Browser.com

For more Market News, visit

www.RealEstate-Browser.com/tag/Market-News

Originally Posted at:

http://www.realestate-browser.com/2012/05/30/north-idaho-re…rested-to-know/

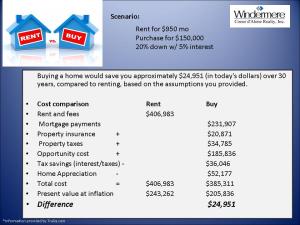

Should I Buy or just Rent? A Cost/Benefit Analysis

You might be surprised to find that a careful Cost/Benefit Analysis still favors BUYING, despite increasing interest rates. Here’s one scenario:

1. The cost of an alternative that must be forgone in order to pursue a certain action. Put another way, the benefits you could have received by taking an alternative action.2. The difference in return between a chosen investment and one that is necessarily passed up. Say you invest in a stock and it returns a paltry 2% over the year. In placing your money in the stock, you gave up the opportunity of another investment – say, a risk-free government bond yielding 6%. In this situation, your opportunity costs are 4% (6% – 2%).Investopedia explains Opportunity Cost

1. The opportunity cost of going to college is the moneyyou would have earned if you worked instead. On the one hand, you lose four years of salary while getting your degree; on the other hand, you hope to earn more during your career, thanks to your education, to offset the lost wages.Here’s another example: if a gardener decides to grow carrots, his or her opportunity cost is the alternative crop that might have been grown instead (potatoes, tomatoes, pumpkins, etc.).In both cases, a choice between two options must be made. It would be an easy decision if you knew the end outcome; however, the risk that you could achieve greater “benefits” (be they monetary or otherwise) with another option is the opportunity cost.

We’d love to help you decide if buying is right for you. Let us help you calculate your own Cost/Benefit Analysis.

208-660-0506

Real estate: It’s time to buy again

Forget stocks. Don’t bet on gold. After four years of plunging home prices, the most attractive asset class in America is housing.

Forget stocks. Don’t bet on gold. After four years of plunging home prices, the most attractive asset class in America is housing.

Castleman is in a unique position to know. As the founder and CEO of a company called Metrostudy, he’s spent more than three decades tracking real-time data on the country’s inventory of new homes….

…Today Castleman is witnessing an extraordinary reversal of the new-home glut that helped sink prices just a few years ago. In the 41 cities Metrostudy covers, a total of 78,000 houses are now either vacant and for sale, or under construction. That’s less than one-fourth of the 343,000 units in those two categories at the peak of the frenzy in mid-2006, and well below the level of a decade ago. “If we had anything like normal levels of buying, those houses would sell in 2½ months,” says Castleman. “We’d see an incredible shortage. And that’s where we’re heading.”

To see where real estate is truly headed, it’s critical to keep your eye firmly on the fundamentals that, over time, always determine the course of prices and construction. During the last decade’s historic run-up in prices, Fortune repeatedly warned that things were moving too fast. In a cover story titled “Is the Housing Boom Over?,” this writer’s analysis found that the basic forces that govern the market — the cost of owning vs. renting and the level of new construction — were in bubble territory. Eventually reality set in, and prices plummeted. Our current view focuses on those same fundamentals — only now they’re pointing in the opposite direction.

So let’s state it simply and forcibly: Housing is back.

Excerpted from

Real estate: It’s time to buy again

Read the full article:

http://finance.fortune.cnn.com/2011/03/28/real-estate-its-time-to-buy-again/

For more information on New Construction in North Idaho, visit Our Listings page.

2011 Windermere Market Review

Our Annual Windermere Report (see link below) is an overview of last year’s real estate market and a forecast of the trends, opportunities, and challenges we can expect in the coming months.

Forecasting the future is always a risky business. However, we continue to remain optimistic about the future of our local real estate market. Why? Because families and retiring baby boomers will continue to seek out healthy communities that offer recreational opportunities, excellent schools and quality health care. And here in Kootenai County, we have these in abundance!

Are you interested in learning how all of this relates to the value of your property in today’s market? Whether you are evaluating investment strategies, tax or estate planning, or perhaps considering a change of address, we are here to help you! We would be happy to prepare a market value report for you, compiled on activity in your local neighborhood and specific to your property.

If you would like a custom market value report, or if you know of someone who needs professional advice regarding real estate, please don’t hesitate to call us.

In the meantime, we hope you find the “Windermere Report” informative. We look forward to talking to you soon.

Sincerely,

2011 Windermere Market Review

Good News: Existing Home Sales Jump

As you wander through life,

As you wander through life,

whatever be your goal,

keep your eye on the donut

and not on the hole!

-Sign in the Mayflower Coffee Shop, Chicago

This quote came to us through our Windermere Coeur d’Alene Realty newsletter this week, and we thought you would appreciate it.

It’s also a great introduction to the Market News that we want to pass along to you today. It’s GOOD NEWS, especially in the context of the news of recent years.

Daily Real Estate News | January 20, 2011

REALTOR® Magazine-Daily News-December Existing-Home Sales JumpExisting-home sales rose sharply in December, when sales increased for the fifth time in the past six months, according to the National Association of REALTORS®.

Existing-home sales, which are completed transactions that include single-family, townhomes, condominiums and co-ops, rose 12.3 percent to a seasonally adjusted annual rate of 5.28 million in December from an upwardly revised 4.70 million in November, but remain 2.9 percent below the 5.44 million pace in December 2009.

Lawrence Yun, NAR chief economist, said sales are on an uptrend. “December was a good finish to 2010, when sales fluctuate more than normal. The pattern over the past six months is clearly showing a recovery,” he said. “The December pace is near the volume we’re expecting for 2011, so the market is getting much closer to an adequate, sustainable level. The recovery will likely continue as job growth gains momentum and rising rents encourage more renters into ownership while exceptional affordability conditions remain.”

The national median existing-home price for all housing types was $168,800 in December, which is 1.0 percent below December 2009. Distressed homes rose to a 36 percent market share in December from 33 percent in November, and 32 percent in December 2009.

“The modest rise in distressed sales, which typically are discounted 10 to 15 percent relative to traditional homes, dampened the median price in December, but the flat price trend continues,” Yun explained.

We’ve been focusing on the donut instead of the hole – and we’ve already closed several transactions in 2011!

We have strategies that WORK! We can help you buy or sell real estate this year. Call us Today!

Randy or Christy Oetken

208-660-0506

Browser’s Friends in Cougar Gulch

Browser wants to give a “Howl-Out” to our new friends in Cougar Gulch area. We sold them this property last year, and we were so pleased to receive their Christmas Card last month. Here are the pictures of their beautiful family enjoying Christmas in their new home!

We would LOVE to help you find your dream home! With low interest rates, abundant choices, and low prices, now is a great time to buy.

Let us help you Own The Lifestyle.

Visit Browser’s Photo Gallery of all his Friends on his Facebook Fan Page “Browser’s BFF’s“

Market News: SOLD Residential Comparison 2005 – 2010

Here’s the data from the Coeur d’Alene MLS.

Are you thinking of selling your home in 2011?

The Pending Home Sales Index,* a forward-looking indicator, rose 10.4 percent to 89.3 based on contracts signed in October from 80.9 in September. The index remains 20.5 percent below a surge to a cyclical peak of 112.4 in October 2009, which was the highest level since May 2006 when it hit 112.6 http://realestatebrowser.wordpress.com/2010/12/07/strong-rebound-in-pending-home-sales/

Find out the true Market Value of your Coeur d’Alene area property. Call us for your FREE Market Analysis.

We’d like to help you decide if the time is right for you to sell your property.

By the way…We Have Buyers!

Strong Rebound in Pending Home Sales

Washington, DC, December 02, 2010

Pending home sales jumped in October, showing a positive uptrend since bottoming in June, according to the National Association of REALTORS®.

The Pending Home Sales Index,* a forward-looking indicator, rose 10.4 percent to 89.3 based on contracts signed in October from 80.9 in September. The index remains 20.5 percent below a surge to a cyclical peak of 112.4 in October 2009, which was the highest level since May 2006 when it hit 112.6.

Last October, first-time buyers were motivated to make offers before the initial contract deadline for the tax credit last November. The data reflects contracts and not closings, which normally occur with a lag time of one or two months.

Lawrence Yun, NAR chief economist, said excellent housing affordability conditions are drawing home buyers. “It is welcoming to see a solid double-digit percentage gain, but activity needs to improve further to reach healthy, sustainable levels. The housing market clearly is in a recovery phase and will be uneven at times, but the improving job market and consequential boost to household formation will help the recovery process going into 2011,” he said.

“More importantly, a return to more normal loan underwriting standards and removal of unnecessary underwriting fees for very low risk borrowers is needed and could quickly help in the housing and economic recovery,” Yun said. Recent loan performance data from Fannie Mae and Freddie Mac clearly demonstrates very low default rates on recently originated mortgages, much lower that the vintages of 2002 and 2003 before the housing boom.

The PHSI in the Northeast jumped 19.6 percent to 71.3 in October but is 27.3 percent below the tax credit peak in October 2009. In the Midwest the index surged 27.3 percent in October to 81.7 but is 24.8 percent below a year ago. Pending home sales in the South rose 7.1 percent to an index of 93.8 but are 18.4 percent below October 2009. In the West the index slipped 0.4 percent to 104.3 and is 15.6 percent below a year ago.

Near term, Yun expects home sales will continue to climb from their cyclical low this past summer. “Even so, we now have some consumer concerns regarding the mortgage interest deduction, an important component in housing affordability,” he said. “Preliminary results of a new survey show nearly three out of four home owners and two out of three renters consider the mortgage interest deduction to be extremely or very important to them. Home owners already pay between 80 and 90 percent of all federal income taxes and additional tax burden would hurt them and the economic recovery, so we have a reasonable hope that it will not be changed.”

The National Association of REALTORS®, “The Voice for Real Estate,” is America’s largest trade association, representing 1.1 million members involved in all aspects of the residential and commercial real estate industries.

###

*The Pending Home Sales Index is a leading indicator for the housing sector, based on pending sales of existing homes. A sale is listed as pending when the contract has been signed but the transaction has not closed, though the sale usually is finalized within one or two months of signing.

The index is based on a large national sample, typically representing about 20 percent of transactions for existing-home sales. In developing the model for the index, it was demonstrated that the level of monthly sales-contract activity parallels the level of closed existing-home sales in the following two months. There is a closer relationship between annual index changes (from the same month a year earlier) and year-ago changes in sales performance than with month-to-month comparisons.

An index of 100 is equal to the average level of contract activity during 2001, which was the first year to be examined as well as the first of five consecutive record years for existing-home sales.

NOTE: The next Pending Home Sales Index will be released December 30 with release dates being moved up for 2011, and existing-home sales for November will be reported December 22; release times are 10:00 a.m. EST.

REALTOR® is a registered collective membership mark which may be used only by real estate professionals who are members of the NATIONAL ASSOCIATION OF REALTORS® and subscribe to its strict Code of Ethics. Not all real estate agents are REALTORS®. All REALTORS® are members of NAR.

http://www.realtor.org/press_room/news_releases/2010/12/strong_phs

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link