North Idaho Real Estate Market News: Residential Statistics January – April 2012

[scribd id=95316467 key=key-n2n5dgurqpz2fbob0gy mode=list]

Originally Posted at:

North Idaho Real Estate Market: You May Be Interested to Know…

We thought you’d like to know a few facts about our ever-changing (improving!) Real Estate Market in North Idaho:

We thought you’d like to know a few facts about our ever-changing (improving!) Real Estate Market in North Idaho:

•Pending Homes sales are the highest they have been since they were impacted by the Home Buyers’ Credit back in April of 2010.

•We are WAY AHEAD of the National Average in Annual Appreciation if you take out the “Boom Years”(late 04-07), and replace them with a steady consistent annual growth rate of 2.4%.

•We are seeing Consistent Activity in the Higher End Market

•Under $150,000 continues to be a Sellers market.

Now you’re asking yourself:

What in the world can I do with this information?

We’d love to help you leverage this info to your advantage. Call us today! We can help you:

- take advantage of historically low interest rates

- gain the advantage in bidding wars

- grow your Real Estate Investment Portfolio

- get the best price for your home, land or commercial property

Call

Randy & Christy Oetken

208-660-0506

Oetken@RealEstate-Browser.com

For more Market News, visit

www.RealEstate-Browser.com/tag/Market-News

Originally Posted at:

http://www.realestate-browser.com/2012/05/30/north-idaho-re…rested-to-know/

NAR: Positive Signs Abound for Housing

The first quarter of 2012 was the best first quarter for real estate in five years, and pending contracts suggest that the second quarter of 2012 will be the best second quarter in five years, NAR Chief Economist Lawrence Yun said this morning at the Residential Economic Update during the NAR Midyear Legislative Meetings & Trade Expo. Moreover, he said the second half of this year could be even better than the first, in part because of continued increases in rental costs and record affordability of homes. “Renters are getting squeezed, and they don’t want to rent anymore,” Yun explained. “This could be the year we see the release of pent-up demand.”

Home prices have been skipping along the bottom for about a year now, Yun said, a trend that has drawn investors into the market. These investors have helped housing through a couple of difficult years and partly mitigated the dysfunctional mortgage market. “Right now is the time to buy low,” he said. “Investors are coming in to take advantage. Second homes started to recover nicely last year because of investors.”

However, home values are poised for a rebound as more traditional buyers move back into the market, Yun said. In fact, this has already started to happen in areas such as Phoenix and Miami, which have seen year-over-year (March 2011 to March 2012) double-digit percentage increases in home prices.As real estate improves, consumer psychology around home ownership will change, he added. Coupled with the recent — if relatively modest — job growth and stock market gains, conditions are right for a sustained housing recovery.

For the full article including the forecast on when interest rates will rise, click here

Positive Signs Abound for Housing NAR Daily Real Estate News | Thursday, May 17, 2012

Re-posted from Realtor Magazine Article: Positive Signs Abound for Housing

Graphic: HouseKeysGray

USA Today: Housing Outlook is More Upbeat

We thought you would want to see this article… more encouraging news about the U.S. Housing Market! You can get the pdf version on our website: www.RealEstate-Browser.com/MarketNews

Housing outlook is more upbeat

Optimism is building that the housing industry is nearing a bottom — finally.

Home sales and home building are forecast to rise this year after sliding steeply the past five years in housing’s worst downturn since the Great Depression.

Recovery is expected to be slow, and home prices are widely expected to fall this year. But investors are betting on the start of an upturn, bidding up home builder stocks and causing them to outperform the broader stock market.

- MORE: Bartiromo: JPMorgan’s Jamie Dimon sees housing at bottom

- MORE: O.J. Simpson faces foreclosure on Miami house

Chief executives are more positive. JPMorgan Chase’s Jamie Dimon said last week that housing is near its bottom but could stay there a year. Stuart Miller, CEO of home builder Lennar, said the market has started to stabilize because of low prices and record-low interest rates.

Market researcher RBC Capital Markets has also turned from a “bearish” view on housing to saying that 2012 “will mark a step in the right direction.”

Many economists expect home prices to fall more this year because of foreclosures and other properties sold at very low prices.

As foreclosures pick up this year, “prices will drop,” says Stan Humphries, Zillow chief economist. He says home prices won’t bottom until later in 2012 or next year.

On average, prices have fallen by about a third since 2006.

“This year will feel a lot better to builders, investors and real estate agents than to consumers,” says Jed Kolko, economist for real estate website Trulia.

Housing’s outlook is brightening with signs of a better economy. Last month, U.S. employers added 200,000 jobs, and the unemployment rate fell to 8.5%, lowest in nearly three years.

While an economic shock could derail progress, “there’s now more evidence of improvement in the economy, and housing will follow the economy,” says David Crowe, chief economist at the National Association of Home Builders. More improvement is expected for:

•Sales. Existing home sales will rise 12% this year after a 2% increase last year, and new home sales, coming off a horrid year, will jump 74% this year, Moody’s Analytics predicts.

November’s existing home sales hit their highest mark in 10 months, and new home sales were the year’s second best, IHS Global Insight says.

•Construction. Single-family housing starts will rise 37% this year, Moody’s predicts, after falling 9% last year.

Home builder stocks are on a run. The S&P 1500 homebuilding index is up 38% since mid-October, vs. 7% for the S&P 500.

For more information about reprints & permissions, visit our FAQ’s. To report corrections and clarifications, contact Standards Editor Brent Jones. For publication consideration in the newspaper, send comments to letters@usatoday.com. Include name, phone number, city and state for verification. To view our corrections, go to corrections.usatoday.com.

<a title="Read it in USA Today" href="http://www.usatoday.com/money/economy/housing/story/2012-01-15/housing-outlook-2012/52584304/1" target="_blank">http://www.usatoday.com/money/economy/housing/story/2012-01-15/housing-outlook-2012/52584304/1 </a>

NORTH IDAHO: Terrific Economic Climate for Business

Is North Idaho Good for Business?

The Idaho Fifth District Legislators seem to think so! Their publication, Northern Idaho Offers Everything a Business Wants and Needs outlines several compelling reasons for businesses to locate or relocate to Northern Idaho. We invite you to download the pamphlet from our website’s Market News page:

www.RealEstate-Browser.com

Bottom Line? Idaho’s Economic Climate is FANTASTIC for Business!

Here’s a summary of the pamphlet’s content:

- Apples-to-Apples Cost Comparisons

Compares the cost of doing business in Idaho vs. California, Oregon & Washington State. Includes costs of Labor, Workers Compensation, Fringe Benefits, Utilities, Property Taxes, Corporate Taxes, Cost of Living.

- Contact Information Resource

Catalogs contact info of key North Idaho Business Leaders, Economic Specialists & Government Officials who can assist potential businesses in their evaluations of locating or re-locating in Northern Idaho.

- Outline of North Idaho’s Educational Opportunities

- Testimonials of Prominent North Idaho Businesses

- Lists North Idaho’s Attractions

Addresses the Quality of Life advantages in living in Northern Idaho.

Interested in re-locating your business to North Idaho? Are you thinking about launching your new Entrepreneurial Endeavor?

We can help!

Call

Randy Oetken,

Realtor (R), CNE

of

Windermere Coeur d’Alene Realty

208-660-0518

View our Commercial Property Listings

or

Search the Coeur d’Alene Multiple Listing Service on our website

www.RealEstate-Browser.com

- NORTH IDAHO: Terrific Economic Climate for Business

- NORTH IDAHO REAL ESTATE: Price Reduction on Lake Coeur d’Alene View Home

Coeur d’Alene MLS Stats: Yearly Market Comparison Median Sales Price Per Quarter

We thought you’d be interested in these stats from the Coeur d’Alene Multiple Listing Service. As you can see from the graph, 2011 Median Residential Sales Prices are DOWN in every quarter over the same quarter last year. This is Good News if you’re interested in purchasing Real Estate!

With lower purchase prices and low interest rates, NOW is a TERRIFIC time to BUY!

We would love to help you purchase your first home, your dream home, or your investment property.

Let us help you “Own The Lifestyle”. Call or Text us Today!

Randy & Christy Oetken

208.660.0506

or Email Us:

Oetken@RealEstate-Browser.com

See

Our Listings or

Search the Coeur d’Alene MLS

Visit RealEstate-Browser.com

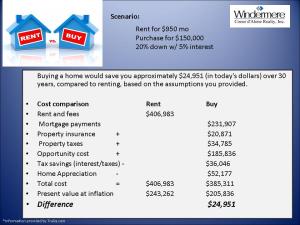

Should I Buy or just Rent? A Cost/Benefit Analysis

You might be surprised to find that a careful Cost/Benefit Analysis still favors BUYING, despite increasing interest rates. Here’s one scenario:

1. The cost of an alternative that must be forgone in order to pursue a certain action. Put another way, the benefits you could have received by taking an alternative action.2. The difference in return between a chosen investment and one that is necessarily passed up. Say you invest in a stock and it returns a paltry 2% over the year. In placing your money in the stock, you gave up the opportunity of another investment – say, a risk-free government bond yielding 6%. In this situation, your opportunity costs are 4% (6% – 2%).Investopedia explains Opportunity Cost

1. The opportunity cost of going to college is the moneyyou would have earned if you worked instead. On the one hand, you lose four years of salary while getting your degree; on the other hand, you hope to earn more during your career, thanks to your education, to offset the lost wages.Here’s another example: if a gardener decides to grow carrots, his or her opportunity cost is the alternative crop that might have been grown instead (potatoes, tomatoes, pumpkins, etc.).In both cases, a choice between two options must be made. It would be an easy decision if you knew the end outcome; however, the risk that you could achieve greater “benefits” (be they monetary or otherwise) with another option is the opportunity cost.

We’d love to help you decide if buying is right for you. Let us help you calculate your own Cost/Benefit Analysis.

208-660-0506

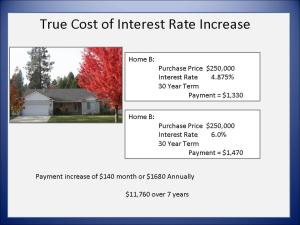

What is the True Cost of the Interest Rate Increase?

Dear Friends,

It’s probably no surprise that rising interest rates have a significant impact on your pocket book.

But how much of an impact? The True Cost may shock you!

Consider this:

The average stay in a home is 5 to 7 years

according to the National Association of Realtors®.

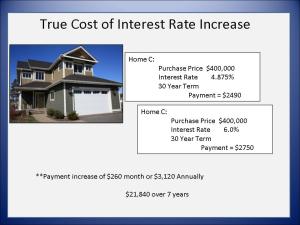

Knowing you like to stay informed, we have provided three real-world home buying scenarios in the graphics below. From these hypothetical comparisons, we hope you can get a better idea of the true cost of the interest rate hikes that are expected in the near future.

Assuming that you remain in your new home for 7 years, it is very clear the HUGE impact of rising interest rates.

WAITING TO BUY could cost you THOUSANDS of dollars!

(Visit our website to view larger PDF graphics of these three scenarios.)

Home “A” Costs $150,000

At the current interest rate of 4.875%, the monthly payment will be $797.

If you wait until the interest rate rises to 6%,

your monthly payment will increase by $85,

for a total annual increase of $1020!

If you stay in that home for 7 years,

you will be spending $7140 MORE!

What could you do with an extra $7140?

Waiting to purchase this $250,000 home could cost you

$140 per month

$1680 per year

If you stay in that home for 7 years,

you will be spending $11,760 MORE!

What could you do with an extra $11,760?

What could you do with an extra

$21,840?

Thinking of buying? Now is a great time, if you want to save $$ in your monthly budget, as well as over the life of your potential mortgage.

Are you waiting for a lower purchase price?

The “savings” of a few thousand dollars off the purchase price will actually COST you THOUSANDS when the interest rates rise.

Don’t wait to make your next Real Estate move.

Call Now

to take advantage of

High Inventory and Low Interest Rates!

As experienced REALTORS®, and long-time North Idaho residents, we can provide an impressive list of professionals whom we’ve come to trust over the years. With our expertise in guiding our clients through all kinds of Real Estate transactions, we are uniquely qualified to help you achieve your real estate goals in 2011!

We’ll help you navigate through every phase of the process.

Randy Oetken 208-660-0518

Christy Oetken 208-660-0506

Oetken@RealEstate-Browser.com

Oetkens Named 2011 Windermere Coeur d’Alene Realty Top Listers

Here’s a “sneak peek” at our Front Page Ad that will be published in tomorrow’s Coeur d’Alene Press.

Thinking of selling? We’re hard workers. Put us to work for you!

Call us for your FREE Comparative Market Analysis.

To see what your home, land, investment or commercial property is worth in today’s market, call

Randy Oetken

208-660-0518

or

Christy Oetken

208-660-0506

of

Windermere Coeur d’Alene Realty

Oetken@RealEstate-Browser.com

We will work hard for YOU!

Visit our websites:

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link